-

IS IT TOO LATE TO BEGIN ADAPTING TO HIGHER VOLATILITY IN THE MARKET? – March 7, 2022

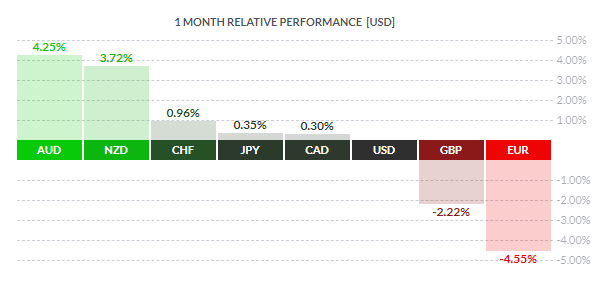

Now is the time for traders to adapt to higher volatility and rapidly changing market conditions. One of the best ways to do this is to monitor different asset...

Read More -

S&P 500 AT TIPPING POINT TO START A BEAR MARKET AND WHAT YOU NEED TO SEE – March 4, 2022

Is a bear market on the way? My research suggests the downward sloping trend line may continue to act as solid resistance – possibly prompting a further breakdown in...

Read More -

THE PUT / CALL RATIO – A TECHNIQUE USED TO GAUGE MARKET EXTREMES – March 3, 2022

Perhaps you’ve heard of the “Put / Call Ratio” (PCR) and been unsure of exactly what it is or when and how to use it. First, a quick review...

Read More -

WILL WAR CHANGE HOW WE SPEND OR INVEST OUR MONEY? – February 25, 2022

I discussed the potential for the invasion into Ukraine with a friend over the past few days and how this new war may change the global economy. We ended...

Read More -

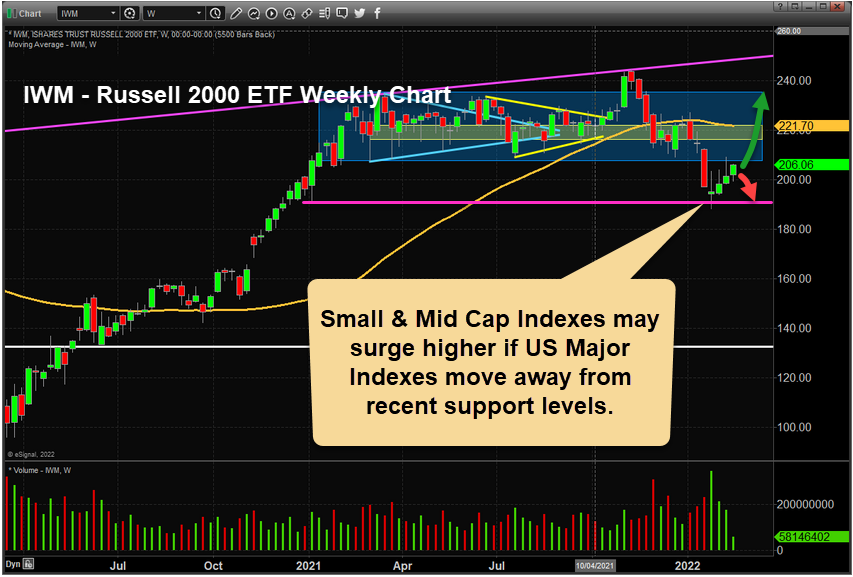

MID & SMALL CAP INDEXES MAY SURGE HIGHER – February 16, 2022

As the global markets move away from recent concerns of war and Fed rate hikes, I believe both Small and Mid Cap indexes are uniquely positioned to potentially surge...

Read More -

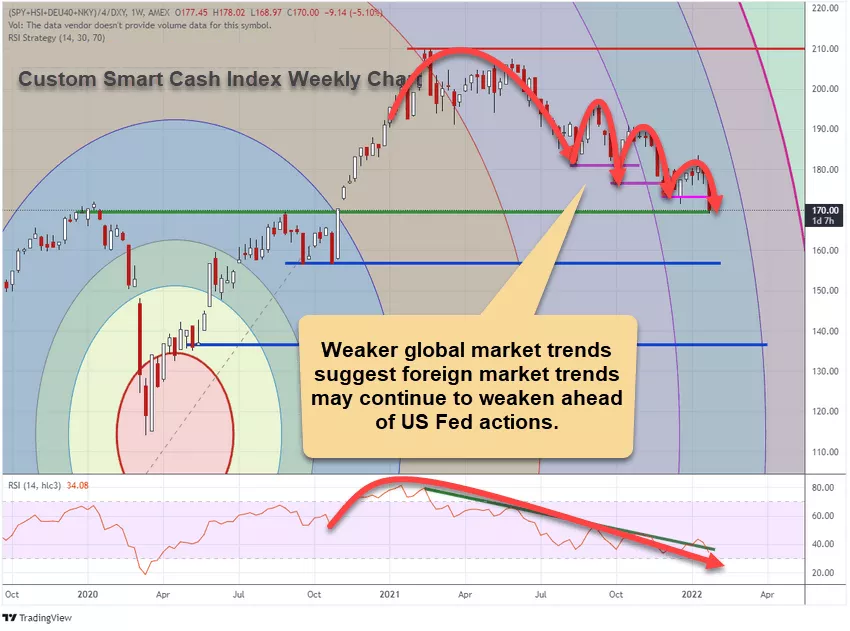

STOCKS FALL AS GOLD AND OIL JUMPS AMID TENSION OVER UKRAINE – FED – February 15, 2022

The FED has made it very clear that it will raise its benchmark interest rate, the federal funds rate. This could have severe consequences and even lead to a...

Read More -

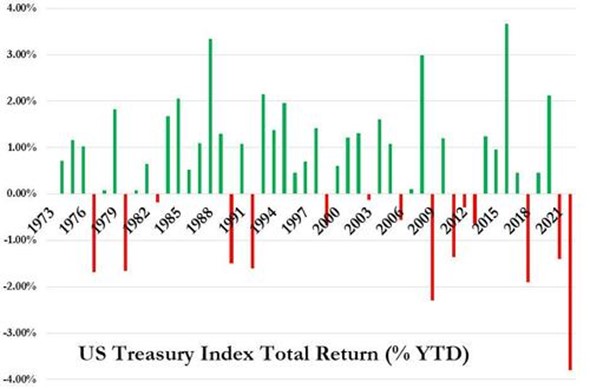

BONDS NOT REFLECTING RISKS LIKE THEY USUALLY DO – WHERE’S THE BEEF? – February 11, 2022

I’ve been paying close attention to Bonds as the global markets react to rising inflation and global central bank moves recently. The US Federal Reserve has yet to take...

Read More -

FED COMMENTS HELP TO SETTLE GLOBAL MARKET EXPECTATIONS – January 28, 2022

The recent Fed comments should have helped settle the global market expectations related to if and when the Fed will start raising rates and/or taking further steps to curb...

Read More -

FINANCIAL SECTOR ETF XLF $37.50 CONTINUES TO PRESENT OPPORTUNITIES – January 27, 2022

Recent volatility in the US markets ahead of the Fed comments/actions have prompted a relatively big pullback in almost every sector. Many traders are concerned the Fed may take...

Read More -

THE SYNTHETIC DIVIDEND OPTION TO GENERATE PROFITS – January 24, 2022

Many companies regularly distribute a portion of their profits in the form of a dividend to attract investors and incentivize them to remain long-term shareholders. But most companies, ETFs,...

Read More