-

US FEDERAL RESERVE – PLAYING WITH FIRE PART II

The US Federal Reserve has recently taken steps to communicate a change in future policy – suggesting raising interest rates and acting more aggressively to combat inflation. Throughout the...

Read More -

DEATH, TAXES, AND TIME DECAY – January 13, 2022

Few things are certain in life. But as the old saying goes, there is nothing quite so certain as “death and taxes”. As an Options Trader, I would enthusiastically...

Read More -

US FED PLAYING WITH FIRE – BUBBLES MAY BURST WHILE BOND YIELDS & METALS RALLY – January 12, 2022

The US Federal Reserve’s tightening monetary policy from a historically low-interest rate has slowed the US stock markets. As a result, traders quickly attempt to adjust their capital allocation...

Read More -

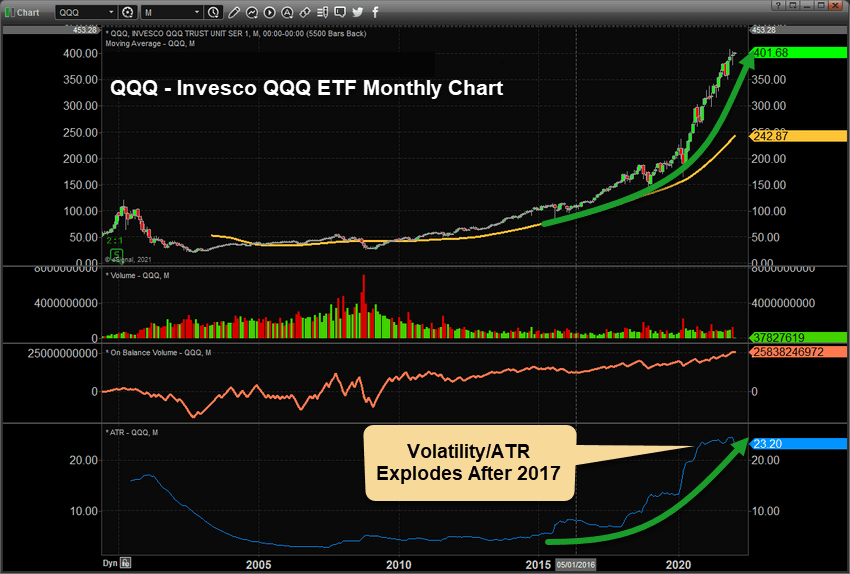

WILL 2022~23 REQUIRE A DIFFERENT STRATEGY FOR TRADERS/INVESTORS? PART III – January 10, 2022

IS THE LAZY-BULL STRATEGY WORTH CONSIDERING? – PART III This last part of our multi-part article compares trading styles amidst the increasing price volatility and extended hyperbolic trending. We’ll...

Read More -

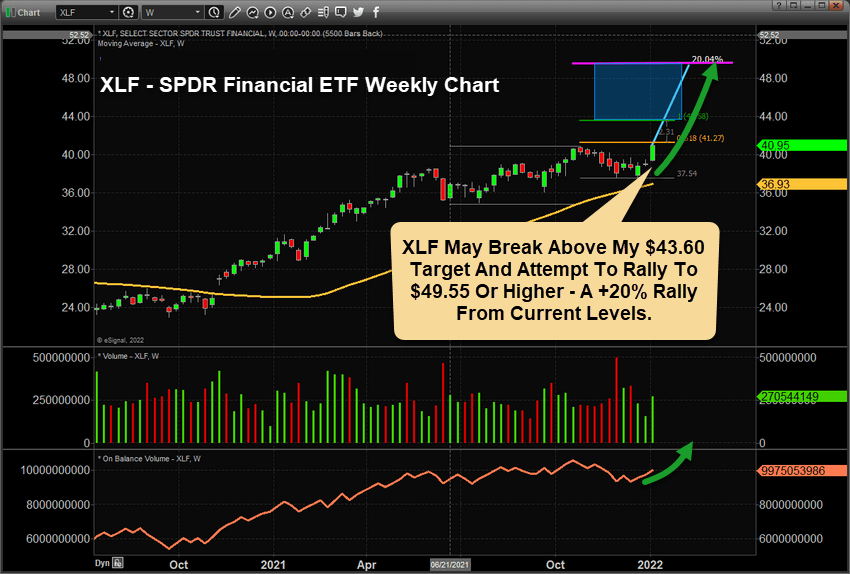

FINANCIAL SECTOR STARTS TO RALLY TOWARDS THE $43.60 UPSIDE TARGET -January 8, 2022

Near November 24, 2021, I published a research article suggesting the Financial Sector, XLF in particular, may bottom and start to move higher, targeting the $43.60 level. After watching...

Read More -

Why Successful Traders Make More By Trading Less – January 7, 2022

During my 25 years of trading and mentoring others, I have been dragged through the coals a few times. And by that, I mean I have; blown up a...

Read More -

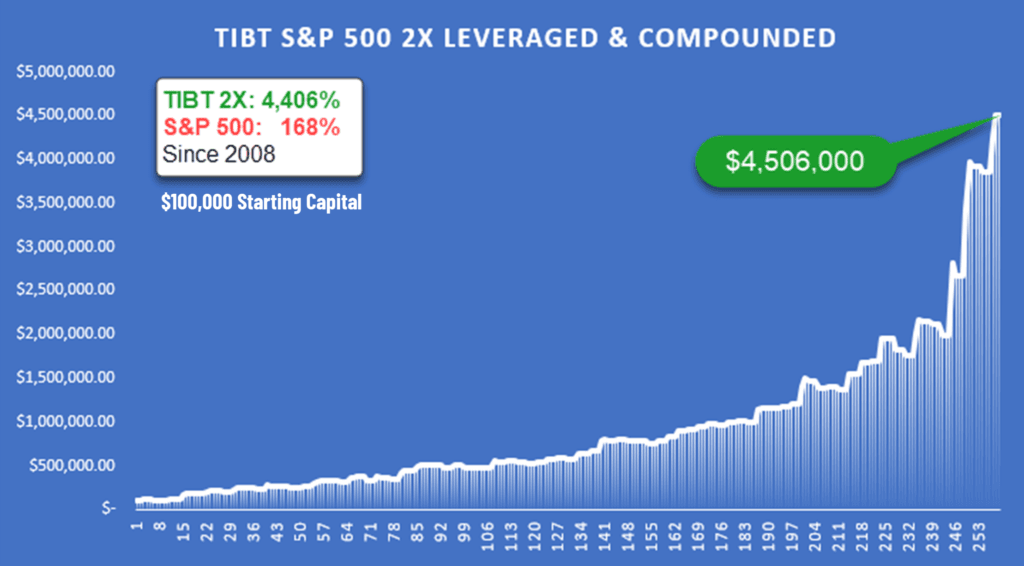

WILL 2022~23 REQUIRE DIFFERENT STRATEGIES FOR TRADERS/INVESTORS? PART II – January 06, 2022

IS THE LAZY-BULL STRATEGY WORTH CONSIDERING? PART II I started this article by highlighting how difficult some 2021 strategies seemed for many Hedge Funds and Professional Traders. It appears...

Read More -

WILL 2022~23 REQUIRE A DIFFERENT STRATEGY FOR TRADERS/INVESTORS? – January 2022

IS THE LAZY-BULL STRATEGY WORTH CONSIDERING? – PART I Many traders struggled in 2021 with the extended price volatility and sideways price trends. Recently, news that Bridgewater’s 2021 results...

Read More -

Early 2022 should continue a melt-up trend in January/February – December 30, 2021

A very late Santa Rally appears to have been set up in the US markets as we close in on the end of 2021. The US markets have already started...

Read More -

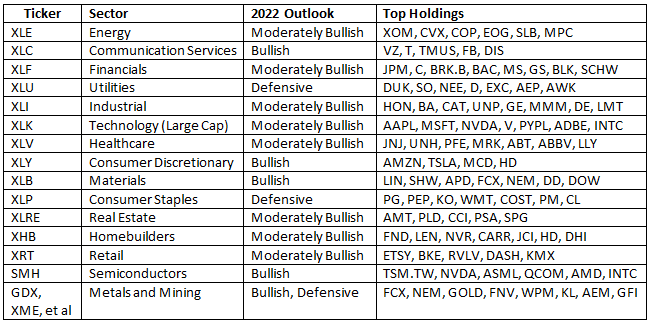

SECTOR THEMES IN PLAY IN THE MARKETS FOR 2022 – December 31, 2021

As 2021 closes, it’s time to consider how sector themes in the markets are likely to perform in 2022. Years like 2021 saw a solid broad-based performance in many...

Read More