-

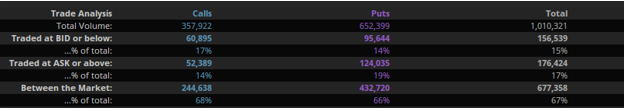

HOW OPTIONS ARE FUELING THE MARKETS – August 16, 2021

In the past week, we have seen the Nasdaq and the S&P reach all-time highs. Since the covid crash, we have seen some massive movement to the upside. I...

Read More -

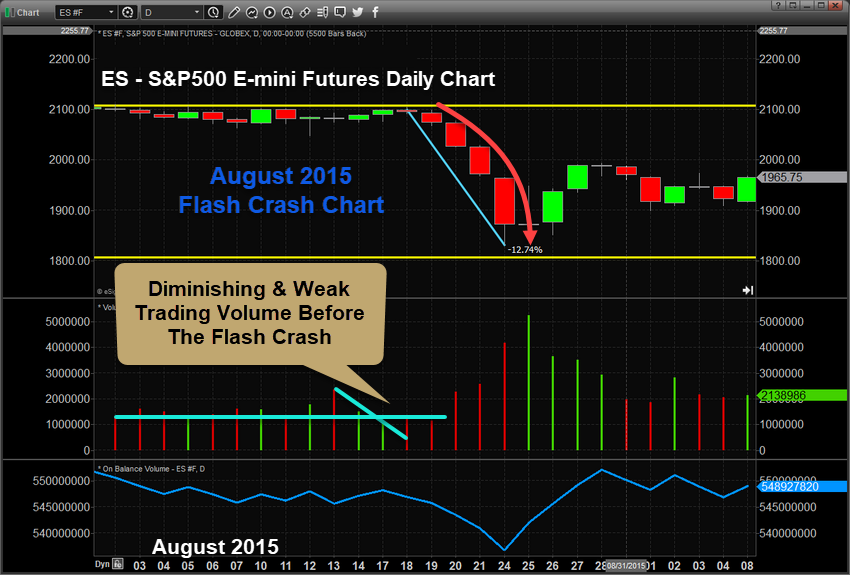

DIMINISHING VOLUME SUGGESTS US STOCK MARKET MOMENTUM IS WEAKENING – POSSIBLY SETTING UP A LIQUIDITY TRAP – August 13, 2021

Weakening volume after an extended rally phase is fairly common. It represents a complacency in the markets where traders/investors are unwilling to chase an extended rally phase at higher...

Read More -

GLOBAL MARKETS START THE WEEK VERY VOLATILE – METALS & OIL COLLAPSE, PART II – August

In this, the second part of our Market Volatility research article, we’ll take a look at how Precious Metals, the US Dollar, and the US major markets have moved...

Read More -

A VOLATILE START TO THE WEEK FOR GLOBAL MARKETS – METALS & OIL COLLAPSE, PART I – August 9, 2021

Overnight, on Sunday and early Monday, Precious Metals and Oil started a fairly big collapse which quickly bottomed and recovered – at least in the Precious Metals markets. Crude...

Read More -

NQ RALLIED TO NEW ALL-TIME HIGHS – ARE WE STARTING ANOTHER BULLISH RALLY PHASE? – August 6, 2021

After the Fed’s comments in support of the US economy and the transitory nature of the recent inflation, the NASDAQ rallied to new all-time highs and closed at $15,167.75...

Read More -

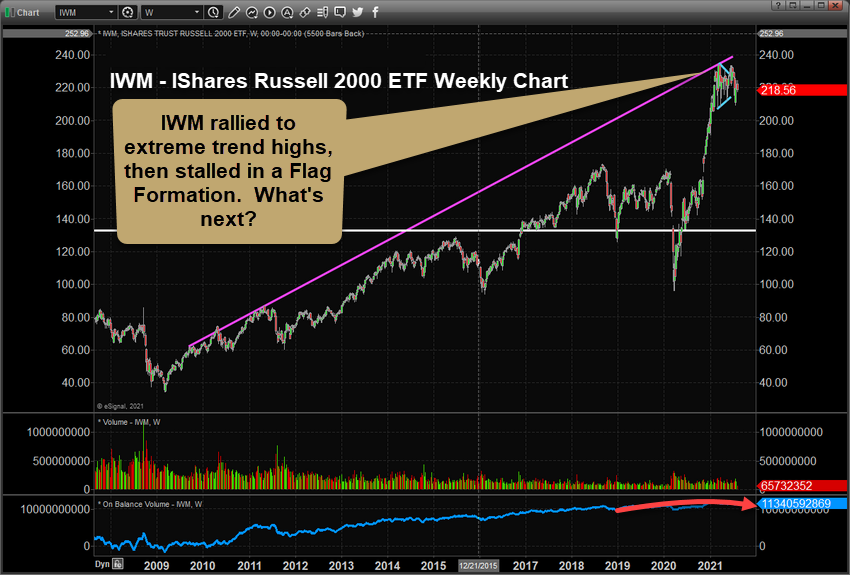

WHEN THE RUSSELL 2000 ETF (IWM) REENTERS PRICE FLAG RANGE – WHAT’S NEXT FOR THE US MARKETS? – August 5, 2021

Early 2021 surprised investors with a very strong bullish price rally in the US major indexes and the Russell 2000. Then, in March, the Russell 2000 peaked near $234.53...

Read More -

US MARKETS STALL NEAR END OF JULY AS GLOBAL MARKETS RETREAT – ARE WE READY FOR AN AUGUST SURPRISE? – August 4, 2021

One thing that seems to be certain in the markets right now is the past hyper-bullish trending which appears to have weakened since early 2021. As a result, the...

Read More -

REVISITING THE EXCESS PHASE PEAK PATTERN – August 3, 2021

The setup of the Excess Phase peak pattern consists of an exuberant rally to a peak (Phase #1), followed by a moderate price correction that sets up into a...

Read More -

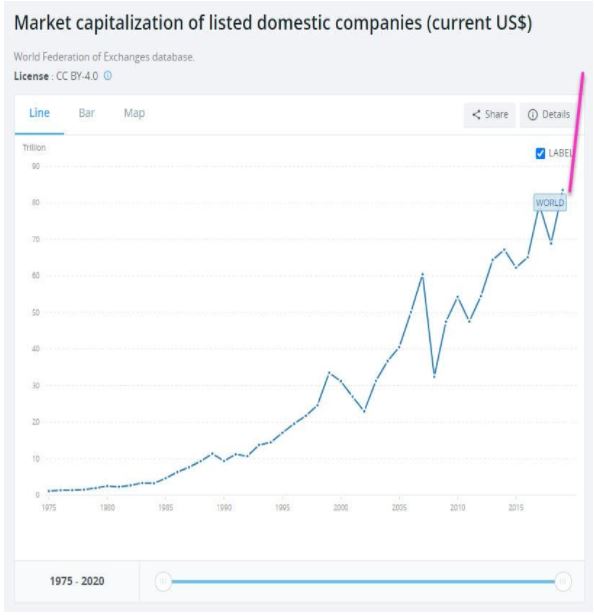

The Inadvertent Debt/Inflation Trap – Is It Time To Face The Music? – July 29, 2021

What happens to a global economy after 10+ years of global central bank efforts to support a recovery attempt after a massive credit/debt collapse originates from a prior credit/debt...

Read More -

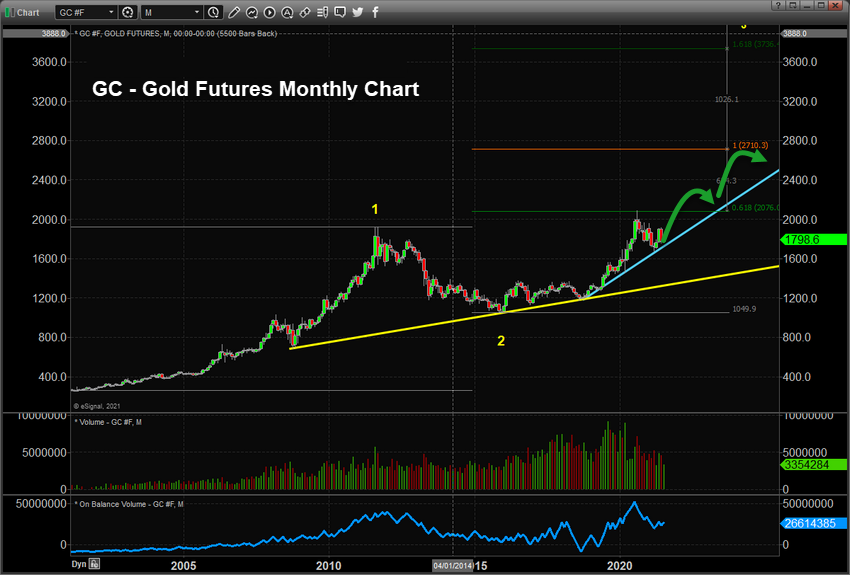

GOLD AND SILVER – WHICH WILL HAVE AN EXPLOSIVE PRICE RALLY AND WHICH WILL HAVE A SUSTAINED ONE? – July 27, 2021

Our followers and readers have been emailing us asking for more research into Precious Metals and updated Adaptive Dynamic Learning (ADL) Price Modeling charts (our proprietary price/technical mapping system...

Read More