-

MARKET VOLATILITY – TRADERS MUST ADAPT OR RISK LOSING THEIR SHIRTS – May 2, 2022

Market volatility remains elevated and may be setting the stage for spikes even higher than we have already experienced. Global money is continuing to flow into the US Dollar...

Read More -

SELLING PUTS – A SIMPLE OPTIONS STRATEGY – April 28, 2022

Selling puts is a neutral to bullish strategy. Traders tend to overcomplicate things. This is especially true with options trading where puts and calls can be bought and sold...

Read More -

USING COMPARISON ANALYSIS FOR AN EDGE – April 27, 2022

Multi timeframe, as well as comparison analysis, have many benefits. As traders, we tend to utilize the shorter-term time frames to enter our trades and place our stops. But...

Read More -

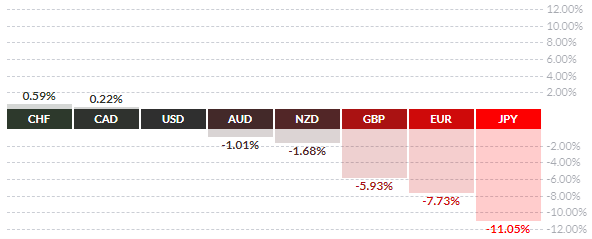

COMBING THRU DATA – LOOKING FOR CLUES ABOUT VOLATILITY, USD & STOCKS – April 25, 2022

We are now seeing that major economies (US/UK/Japan) are not immune from global deleveraging and inflation. As investors seek safety in the US Dollar this may eventually trigger a...

Read More -

GLOBAL MARKET TRENDS CONTINUE TO PUSH US DOLLAR & US ASSETS HIGHER – April 21, 2022

Every day seems filled with some new comment or data point that suggests the Global Market or the US Fed will aggressively attempt to burst the inflation bubble. Global...

Read More -

WHERE ARE INVESTORS PUTTING THEIR MONEY -NOW VS. THEN? – April 20, 2022

Investors have been processing high inflation reports, rising interest rates, surging energy, commodity, and real estate prices. So, what is the market saying about which markets investors have favored...

Read More -

TRADING MAJOR INDICIES WITH MULTIPLE TIME FRAME ANALYSIS – April 18, 2022

There are many benefits to utilizing multiple time frame analysis in your trading. Some of the standard time frames are monthly, daily, weekly, 4-hour, 1-hour, etc. Longer-term traders may...

Read More -

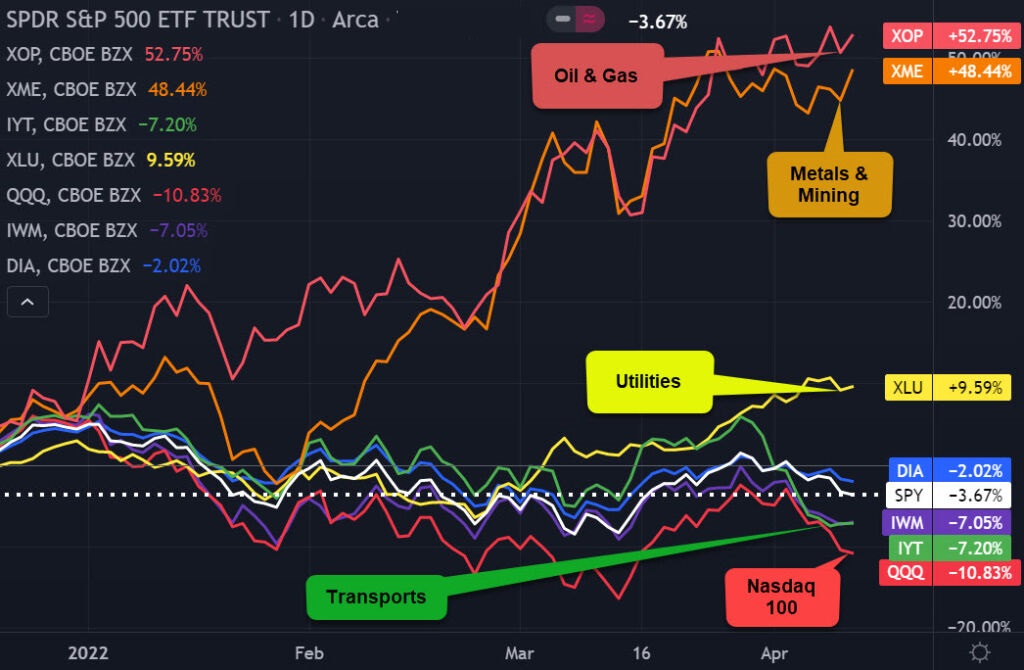

MAJOR INDEXES CONTINUE TO BE OUTPERFORMED BY ENERGY & METALS – April 13, 2022

Recent rallies in the major indexes have had a hard time hanging onto their gains lately. ETFs like XOP (S&P Oil & Gas Exploration & Production), XME (S&P Metals &...

Read More -

UTILITIES RISING & TRANSPORTERS SINKING – SECTOR ROTATION IS PROVIDING CLUES – April 11, 2022

Historically, investors gravitate toward more defensive and commodity-focused sectors, such as precious metals, energy, commodities, and utilities, in late-cycle bull markets. Recently, the stock market is beginning to show...

Read More -

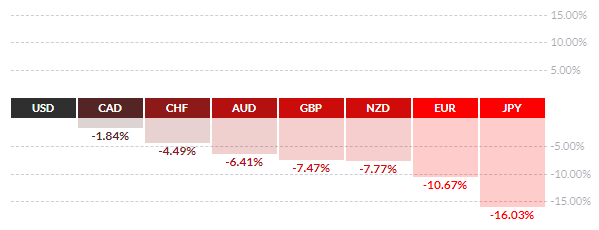

U.S. DOLLAR (USD) IS ON OUR RADAR!

Since the USD plays such a strong role in global economics, we thought it appropriate to see how the USD performance is vs. other currencies and investments. For the...

Read More