-

GOLD-TO-SILVER RATIO HEADING LOWER – SETUP LIKE 1989-03 – August 9, 2022

Fear is starting to become an issue. Traders are starting to realize inflation, CPI, PPI, and global currencies are reacting to the sudden policy shift by the US Fed...

Read More -

SHOULD WE BE PREPARED FOR AN AGGRESSIVE U.S. FED IN THE FUTURE? – August 4, 2022

Traders expect the U.S. Fed to soften as Chairman Powell suggested they have reached a neutral rate with the last rate increase. The US stock markets started an upward...

Read More -

US FED – THE BATTLE AGAINST EXCESS GLOBAL CAPTIAL CONTINUES – July 29, 2022

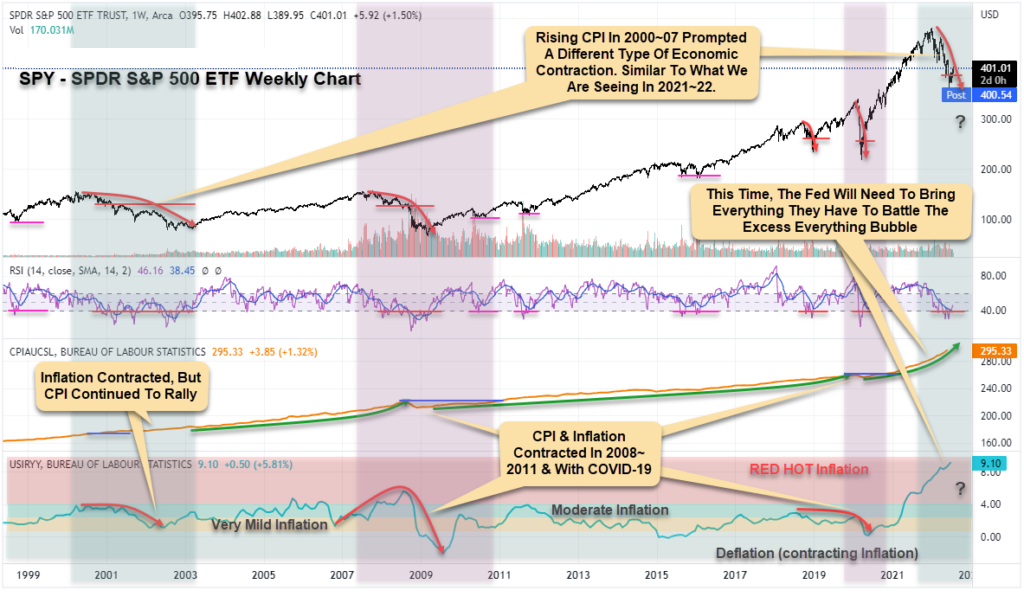

US FED IS BATTLING EXCESS GLOBAL CAPITAL – WHICH IS CREATING INFLATION The US Fed continues to bring the big guns, raising rates another 75 bp (0.75%) on July...

Read More -

FUNDAMENTAL VS. TECHNICAL ANALYSIS – WHAT’S YOUR STYLE? – July 27, 2022

In investing and trading, we often hear debates on the merits of fundamental vs. technical analysis. Both aim to improve our probability of a profit. Both methods have their...

Read More -

DO FED RATE DECISIONS AFFECT THE PRICE PATTERNS FOR GOLD? – July 21, 2022

Many traders are focused on Gold as price has contracted over the past 5+ weeks, and the $1700 level is being retested. This prompted my team and I to...

Read More -

WILL U.S. DOLLAR UPTREND SLOW FOREIGN REAL ESTATE INVESTMENT IN THE US? – July 19, 2022

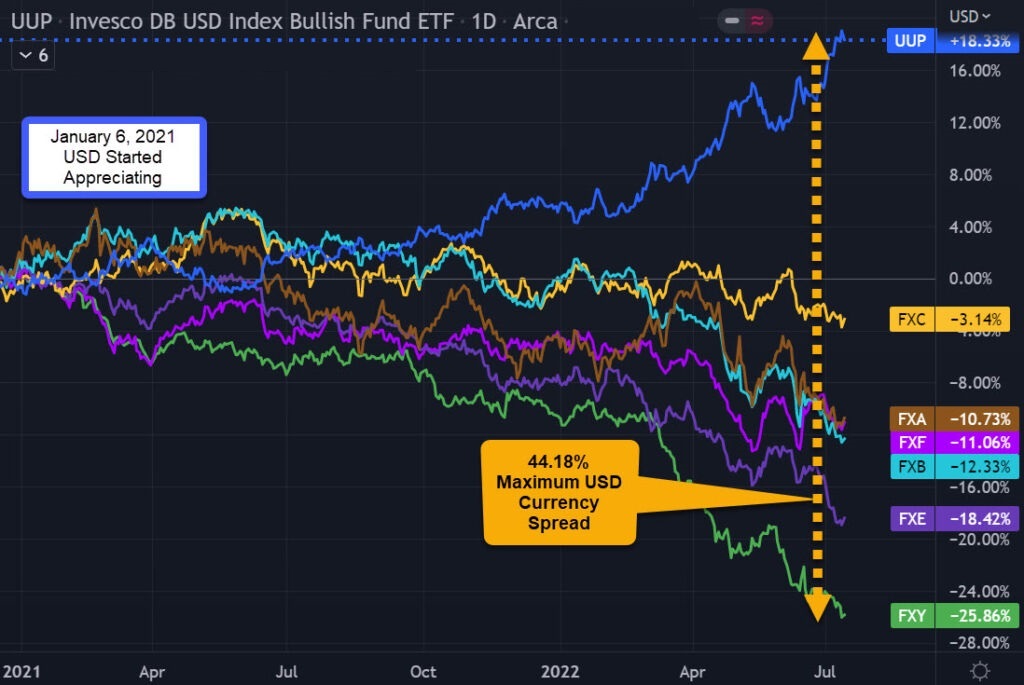

The U.S. Dollar uptrend has been going on since January 6th, 2021: U.S. Dollar is at a 14-year high 2020-2022 U.S. Presidential Cycle: USD appreciated +18.33% to date 2016-2020...

Read More -

WHAT ARE THE DRIVING FORCES BEHIND THE SHIFT IN GLOBAL MARKET RISKS? – July 14, 2022

Global market risks have shifted dramatically over the past 90+ days. It almost seems as though the global markets turned 180 degrees overnight, generally going from moderately soft monetary...

Read More -

COMPARED TO THE USD, AUTO COMPANY STOCKS ARE ON A SUMMER VACATION – July 13, 2022

Summer is here, and it’s time for a vacation. But this year, flight schedules are anything but reliable, and that new car for the road trip is probably not...

Read More -

DOES SELLING PUT OPTIONS DURING A MARKET DOWNTURN PROVIDE A SAFETY NET? – July 8, 2022

In a significant market downturn, bearish sentiment, if not outright fear, can drive down the share price of good companies rather drastically. When the market is in a sustained...

Read More -

CRUDE OIL COLLAPSED BELOW $100PPB – HAS THE US FED BROKEN INFLATION? – July 7, 2022

On Tuesday, July 5th, Crude Oil collapsed very sharply, down over 10% near the lows, in an aggressive breakdown of the price. The $97.43 lows reached that day were...

Read More