-

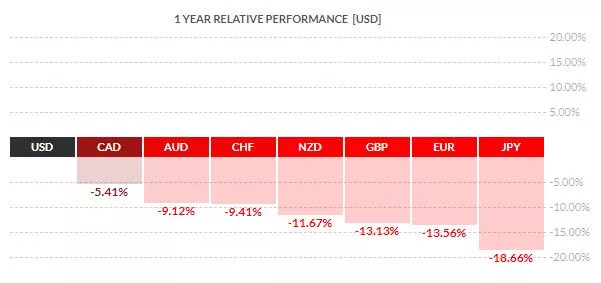

U.S. DOLLAR TRENDING HIGHER AS PRIMARY GLOBAL RESERVE CURRENCY – July 6, 2022

The U.S. Dollar is one market that continues to stand out as a stronghold for traders and investors. The world’s primary reserve currency, the USD, remains solidly above all...

Read More -

CONSUMER CONFIDENCE DIPS LOW IN THE FACE OF INFLATION – June 30, 2022

As the Fed continues to posture future rate increases to battle inflation, recent economic data shows Consumers are in a state of shock as price factors continue to skyrocket....

Read More -

IS THE INFLATION BOOM QUICKLY TURNING TO AN INFLATION BUST? – June 27, 2022

The last few months have been very interesting as we see traders (rotating) moving out of one investment or market and into another. But as losses mount and capital...

Read More -

CRUDE OIL TREND BREAKS DOWNWARD – REJECTING THE $120 PRICE LEVEL – June 23, 2022

The recent downward Crude Oil trend may have caught many traders by surprise. Just before the US Fed raised interest rates on June 15, 2022, Crude oil was trading...

Read More -

AS MARKET TRENDS CONTINUE TO DROP – WHERE IS A GOOD PLACE TO INVEST? – June 21, 2022

Market trends continue to drop due to investor concerns about geopolitical events, record inflation, rising interest rates, slowing housing, plummeting auto sales, increasing retail inventories, expanding consumer credit, and...

Read More -

WILL GLOBAL MARKETS BE PUSHED DEEPER INTO CRISIS EVENT BY THE US FED? – June 16, 2022

US and Global markets recoiled from the higher inflation/CPI data last week. The US Fed raised interest rates by 75pb on June 15. The Fed also warned that other,...

Read More -

INVESTORS WHO ARE LIQUIDATING TO A CASH POSITION – WHAT TO DO NEXT? – June 13, 2022

Bank of America, Michael Hartnett, Chief Investment Strategist recently stated, “The bear-market rally for stocks has disappeared as investor concerns about inflation and interest rates linger.” “We’re in a...

Read More -

TRADING THE CALM BEFORE THE STORM – CONSIDER PUTTING ON A LONG STRANGLE – June 11, 2022

There are times when markets consolidate and move sideways in a relatively narrow range. We often see low volatility, little trending, and “choppy” price action when the market is...

Read More -

CRUDE OIL PRICE AND CONSUMER SPENDING – HOW THEY ARE RELATED – June 09, 2022

Crude Oil & Gasoline prices have been a hot topic for almost everyone recently. As inflation surges, consumers are feeling the increased pricing pressures from all sides right now....

Read More -

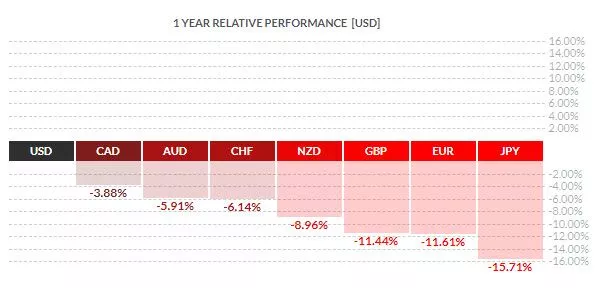

STRONG U.S. DOLLAR BITING INTO MULTINATIONALS – June 6, 2022

“A hawkish Federal Reserve and heightened geopolitical tensions have driven a 14% gain in the U.S. dollar against a basket of currencies over the last year, forcing companies such...

Read More